The Mexico Recruiting Revolution:

A Strategic Analysis for 2025-2030

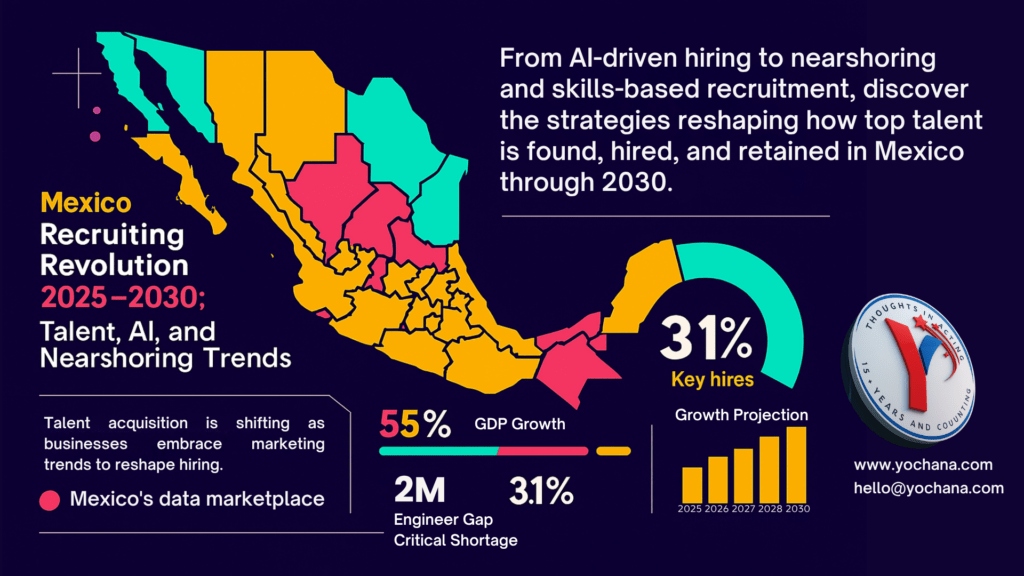

How nearshoring, digital transformation, and talent shortages are reshaping Mexico’s recruitment landscape

Executive Summary

Mexico stands at the precipice of the most significant recruiting transformation in its modern history. With GDP growth projected at 2.4% for 2025 and an unprecedented wave of nearshoring investments flowing from the United States, the country presents both extraordinary opportunities and critical challenges for talent acquisition professionals.

Our analysis reveals a market defined by contradictions: explosive demand for skilled workers alongside a critical shortage of 2 million engineers across key sectors. Companies that master this complex landscape will gain access to cost-effective, culturally aligned talent pools that could define competitive advantage for the next decade.

The Nearshoring Tsunami: Driving Unprecedented Demand

Market Dynamics

The U.S.-Mexico economic relationship has fundamentally shifted. No longer viewed as merely a low-cost manufacturing hub, Mexico has evolved into a strategic partner offering deep talent pools in automotive, electronics, and textiles. Workers bring not just technical skills but crucial familiarity with U.S. markets—a combination proving irresistible to American companies seeking to diversify supply chains.

Key Statistics:

- Mexico offers average tech salaries of $55,500 compared to $109,000 in the U.S.—a 49% cost advantage

- 58% of talent acquisition specialists have already adopted virtual interview processes

- GDP growth holds steady at a projected 2.4% rise in 2025, demonstrating economic resilience

Geographic Concentration

Manufacturing clusters in Nuevo León, Jalisco, and Baja California have become magnets for investment, creating regional talent demand that far exceeds local supply. These hubs represent more than manufacturing centers—they’re emerging as integrated ecosystems where technology, engineering, and business services converge.

The Talent Paradox: Shortage Amid Abundance

The 2 Million Engineer Gap

Perhaps the most striking finding in our analysis is the scale of Mexico’s talent shortage. The Pan American Development Foundation estimates a shortfall of 2 million engineers across IT, manufacturing, biotechnology, and artificial intelligence—sectors driving nearshoring growth.

This shortage manifests differently across industries:

Manufacturing: 35% of manufacturers report persistent struggles to secure skilled technical workers, limiting their ability to capitalize on nearshoring opportunities.

Technology: While demand for IT roles surges with manufacturing digitization, qualified candidates remain scarce, particularly in emerging fields like AI and machine learning.

Informal Economy Impact: With 54.6% of Mexico’s workforce entangled in informality, productivity remains constrained, creating additional recruitment challenges for formal sector employers.

Skills Mismatch in the Digital Age

The shortage isn’t simply numerical—it’s qualitative. As Industry 4.0 transforms Mexico’s manufacturing base, the demand for workers who can bridge traditional manufacturing expertise with digital fluency has exploded. Companies need bilingual professionals who understand both technological systems and U.S. business culture, a combination that remains rare.

The Virtual-First Revolution

Technology Adoption in Recruitment

The pandemic accelerated digital transformation in Mexican recruitment, with 58% of talent acquisition specialists now implementing virtual interviews. This shift has profound implications:

Geographic Expansion: Companies can now access talent pools across Mexico’s diverse regions without geographic constraints.

Speed to Hire: Virtual processes have compressed recruitment timelines, critical in competitive talent markets.

Cultural Alignment: Video interviews allow better assessment of soft skills and cultural fit—essential for cross-border roles.

Cross-Border Talent Integration

Virtual-first recruitment has enabled a new model: Mexican professionals working remotely for U.S. companies while maintaining local residence. This approach offers companies the cost advantages of nearshoring with the cultural benefits of domestic talent.

Industry-Specific Demand Patterns

Manufacturing: The Foundation Sector

Manufacturing remains the cornerstone of Mexico’s nearshoring appeal. Automotive, electronics, and aerospace companies are establishing sophisticated operations requiring workers who can operate advanced machinery while interfacing with global supply chain systems.

Critical Roles:

- Quality assurance engineers with Six Sigma certification

- Maintenance technicians skilled in predictive analytics

- Supply chain coordinators with ERP expertise

Technology: The Growth Multiplier

Technology roles in Mexico fall into two categories: those supporting manufacturing digitization and those serving the broader North American market. Both segments show explosive growth but require different skill sets.

High-Demand Positions:

- AI/ML specialists (22% projected growth in cross-border hiring)

- Cybersecurity professionals for manufacturing systems

- Software engineers with bilingual communication skills

Finance and Business Services: The Enabler Sectors

As manufacturing operations scale, demand for supporting business functions has surged. Finance, logistics, and customer service roles represent opportunities for professionals with strong English skills and U.S. business acumen.

Strategic Implications for Talent Acquisition

Rethinking Recruitment Strategies

Traditional recruitment approaches prove inadequate in Mexico’s transformed landscape. Successful companies are implementing comprehensive strategies addressing both immediate needs and long-term talent development.

Emerging Best Practices:

- University Partnerships: Building relationships with technical institutes to create talent pipelines

- Skills-Based Hiring: Focusing on competencies rather than formal credentials

- Cultural Integration Programs: Ensuring Mexican talent understands U.S. business norms

- Remote Work Infrastructure: Enabling seamless cross-border collaboration

Investment in Talent Development

The talent shortage forces companies to think beyond traditional hiring. Leading organizations are investing in comprehensive training programs, often partnering with educational institutions to develop curriculum aligned with industry needs.

Compensation Strategy Evolution

While cost advantages remain significant, successful companies are moving beyond purely cost-driven compensation strategies. Total rewards packages increasingly include professional development, career progression, and cultural integration opportunities.

Regional Variations and Opportunities

Northern Border States

States like Nuevo León and Baja California offer proximity to U.S. markets but face intense competition for talent. Companies here must differentiate through career development opportunities and workplace culture.

Central Mexico Hubs

Jalisco and surrounding areas provide strong educational infrastructure and lower cost bases but require investment in English language training and U.S. business culture education.

Emerging Regions

States like Yucatan and Queretaro represent untapped potential, offering lower competition for talent but requiring more significant infrastructure investment.

Risk Factors and Mitigation Strategies

Talent Competition Intensification

As more U.S. companies establish Mexican operations, talent competition will intensify. Companies must develop compelling employer value propositions extending beyond compensation.

Regulatory Compliance Complexity

Mexico’s labor laws require careful navigation, particularly for cross-border employment arrangements. Companies need robust legal frameworks to ensure compliance.

Cultural Integration Challenges

While Mexican professionals often demonstrate strong technical skills, integrating them into U.S. corporate cultures requires dedicated support systems.

Future Outlook: 2025-2030 Projections

Growth Trajectory

Our analysis suggests Mexico’s recruiting market will experience sustained growth through 2030, driven by:

- Continued U.S. supply chain diversification

- Mexico’s competitive advantage in key manufacturing sectors

- Growing sophistication in technology services delivery

Emerging Opportunities

Industry 4.0 Implementation: As manufacturers adopt advanced automation, demand for workers capable of managing human-machine interfaces will surge.

Sustainable Manufacturing: Environmental regulations and corporate sustainability commitments will create new role categories requiring specialized expertise.

Financial Technology: Mexico’s growing fintech sector will drive demand for professionals combining financial expertise with technological fluency.

Recommendations for Stakeholders

For Talent Acquisition Professionals

- Invest in Virtual Infrastructure: Build robust remote interview and onboarding capabilities

- Develop Cultural Competency: Understand Mexican business culture and communication styles

- Create Talent Communities: Build relationships with candidates before immediate hiring needs arise

- Partner with Education: Collaborate with universities and technical schools to influence curriculum

For Business Leaders

- Think Long-Term: View Mexican talent acquisition as strategic investment, not tactical cost reduction

- Invest in Development: Budget for comprehensive training and professional development programs

- Build Local Presence: Establish meaningful operations in Mexico rather than treating it as remote workforce

- Focus on Retention: Develop compelling career progression paths to retain top talent

For Mexican Professionals

- Develop English Proficiency: Bilingual capability remains the strongest differentiator

- Understand U.S. Business Culture: Invest time learning American professional norms and communication styles

- Embrace Technology: Stay current with digital tools and platforms used in North American business

- Build Cross-Cultural Networks: Develop professional relationships spanning both countries

Conclusion: Seizing the Moment

Mexico’s recruiting revolution represents more than market opportunity—it’s a fundamental reshaping of North American talent flows. The companies, professionals, and institutions that recognize this transformation’s scope and act strategically will define the next decade of cross-border business success.

The data is clear: Mexico offers unprecedented access to cost-effective, skilled talent aligned with U.S. market needs. However, success requires moving beyond simple cost arbitrage to build genuine partnerships, invest in talent development, and create cultural bridges spanning both countries.

The revolution has begun. The question isn’t whether to participate, but how quickly and effectively organizations can adapt to this new reality.

For more insights on Mexico’s recruiting transformation and strategic talent acquisition, visit YOCHANA.COM – your partner in cross-border talent excellence.